12 Ways To Save On Household Expenses In Kenya

The cost of living is on everyone's mind, and we're all feeling the pinch.

By Wanjiru Gathanga • In partnership with Kapu.

With a few practical changes, you can save money. Household expenses usually take up the most of our budgets, so here are 12 smart strategies to help you cut costs and keep more cash in your pocket. 😉

1. Track Your Spending & Budget

Huwezi save doh kama hujui unaingiza ngapi na unatumia ngapi. Kama wewe hutumia mobile money kama M-Pesa, AirtelMoney ama TKash, kuangalia statements zako intakuonyesha vile wewe huspend.

Uko in control of your money? Chukua the MESH Control Your Dough quiz to find out.

Na kama unadai kutake control of dough yako… Here are 5 steps to take control of...

2. Zoea Kutumia Shopping List

Shopping list husaidia kuavoid what we call impulse purchases. Umewahi enda supa na plans za kuspend 200bob on a sabuni ya kipande, but instead ukajipata umetoka na kichana, plastic dish, shoe polish na 800bob less kwa mfuko? 😂Usajali, mimi pia nimejipata kwa hiyo fix.

Hiyo ndiyo impulse buying! Sio ati kusema ati hizo vitu umebuy sio useful, but hiyo haikuwa plan, na sasa umespend fare ya next week on stuff deep down unajua hukuwa unahitaji.

And as long as tunakuwa honest, hivyo ndio utajipata na Fuliza ngware Monday ukitafuta fare ya kuenda job.

Kuavoid hii fix, unda shopping list. Write down what you really need, alafu ustick to your monthly or weekly budget.

3. Tumia Grocery App Iko na Deals Kibao

Kununua goceries zako kwa online store pia inaweza kusaidia na impulse buying yenye tume mention, juu hupati tamaa ya kuongeza vitu huhitaji ukiziona kwa shelf.

Kuna a new grocery app Kanairo (na soon across Kenya) yenye iko na great deals: Kapu

MESH ina team up na Kapu kuoffer MESHERS great deals on products kama sabuni na detergent, fresh produce na groceries zako, sodas and more..

Uki order online kutoka Kapu, wata deliver order kwa kiosk iko karibu na wewe mtaani.

Unaweza download the Kapu app for free kwa play store.

4. Buy in Bulk at Wholesale Prices

Tip ingine ni kufanya shopping yako ni bulk. Hii itakusave doh mob in the long run. Stuff kama mchele, unga na mafuta ya kupika utapata hukuwa cheaper ukinunua in large quantities.

Na pia, compare prices between soko, supermarkets different na online platforms ili upate the best deals.

But kubuy in bulk pia unaweza pata ni too expensive, right?

Shikana na mabeshte, family, neiba ama chama kubuy in bulk pamoja alafu mnashare cost na savings. Chamas zingine hata huwa na merry-go-rounds specific ya household shopping, so unaweza introduce the idea kwa chama yako.

5. Substitute Expensive Brands for Cheaper Alternatives

Ukishop, chagua more affordable brands. Low-cost brands mob huoffer the same quality as zile premium, but only for a fraction of the price.

For example, ukibuy soap, unaweza opt for local brands badala ya zile brand za majuu. Utapata zinawaork just as effectively. Na even then, be sure that ume compare prices and quantity to get the best deal.

Cheki hii example ya detergent prices kwa supermarket fulani kanairo.

500g ya Ariel Detergent niKES 260

500g ya Msafi Detergent ni KES 129

400g ya Sunlight Detergent ni KES 160.00

Ni gani inakupea the best value for doh zako?

In the same way, unaweza badilisha from branded ama packaged food kama mchele, unga na foods zingine unaweza buy kwa shop ya cereals. Utapata ni more affordable juu hazijakuwa packed packet by packet, na mwenye cereals shop amebuy in bulk at a lower price. Na pia badala ya kununua milk ya packet, utapata more milk kwa atm pale mtaani.

Hizi tips zotei ni part ya kucompare prices when shopping. Soma label kuensure that unapata the best out of your money, no matter how affordable something is. Over time, hizi small changes zinaweza kupea savings mob on your monthly shopping bill.

5. Check & Manage your Utility Bills

Utility bills kama stima na maji pia zinaweza chukua chunk kubwa ya budget yako, but unaweza zipunguza by being mindful of your usage.

One of the ways to do this ni by kutumia energy-saving electronics to save money on bill yako ya KPLC. Wengi wetu tuko na multiple electronics kwa nyumba. Bulbs, electric kettle, fridge, microwave, instant shower, radio, TV, pasi… and so on. Ni appliances ndogo ukiziangalia, but they’re the secret behind your crazy KPLC bill mwisho wa mwezi, ama the reason metre yako ya token huimba kama success card every 3 days.

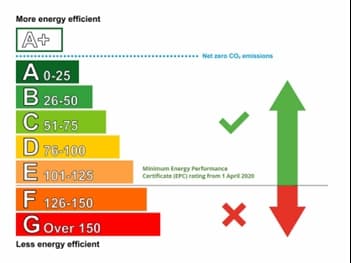

So utajuaje kama appliance zako ni energy-saving? Most electronics siku hizi ziko na label that shows their energy rating from the letter A-G.

Hii rating itakusho how much energy an appliance uses and will make it easier for you kucompare consumption ya two choices of appliances. The closer to A rating iko nayo, the more energy efficient an appliance is, so inatumia stima less, na the less so inaweza reduce doh unaspend on power. Kama uko kwa soko for a new appliance, keep this in mind.

Alafu tumia electronics sparingly. Hii inamaanisha hakuna kuchemsha maji ya kufua nguo na kettle 👀 Zima lights pia kama huzitumii💡As a Kenyan, modeh shuleni na wazazi nyumbani probably yelled this all the time. But ulidhani wao ni watiaji 😂 Sasa wewe ndiye mwenye nyumba na bills ni zako. Take charge of your money 💸

Ukimalizana na KPLC, kanjo wanabisha bill ya maji. Make sure pia that unatumia maji sparingly for your household chores to reduce bill mwisho wa mwezi. Hakuna haja ya kuambiwa usiwache maji ikimwagika, right?

Hizi small changes zinaweza kusaidia kuyou cut down on bills without compromising your comfort.

6. Cook & Eat at Home

Number 6 on the list ni food mwitu! Of the things that might surprise you ukiangalia statement ya mpesa, ni how much money you spend on smochas, mayai, smokie pasua and chips and chicken. Ama wewe huendea chapo na samosa? Ama mutura?

Whatever your guilty pleasure is, food yoyote mwitu ni tasty, but kama ni mazoea… unapoteza doh.

Kupika at home ni much cheaper and healthier. Think about it… ukitaka kujitreat to some junk food… chipo ya 150 ni kasuku mzima ya waru!! Enda tu home and cook yourself some tasty home-made fries 🍟 We all know they slap!

7. Cancel Unnecessary Subscriptions

You may not realize it, but if you kama uko na multiple subscriptions kama Netflix, Showmax, Skiza tunes, Daily SMS messages or data bundles, hiyo doh ina add up.

Netflix ni 200 bob a month na Showmax ni 300 bob a month. Unahitaji zote mbili?

Na kama uko na sms subscriptions za daily Bible or Quran verses, betting tips, news, daily jokes? Unajua unaspend how much per month? SMS moja inaweza kuwa anywhere from 0.5 to 2 bob a day.

Na watu wa skiza tunes? In 2021, Safaricom wanai-estimate that 9 million Kenyans have skiza tunes, na kama wewe ni mmoja wao, that’s 1.5bob a day.

Uko na subscriptions ngapi, na unaspend how much? You could easily be saving thousands of shillings a year by cancelling them. Review all your monthly subscriptions and cut out the ones you can live without.

8. Consider Sharing Rent or moving

Rent ni another large expenses for watu wayoung. Kama unaishi pekee yako, unaweza consider kuishi na beshte ama family ili msplit rent na bills.

Njia ingine ya kureduce rent yako ni by kuhamia nyumba ndogo. Kama budget yako ni ya bedsitter budget, nyenyekea. Hakuna haja ya kuenda over budget kuishi kwa 1 bedroom. Budget yako ndio hudictate how much unafaa kuwa unalipa. Hii itakusave from padlock za caretaker na landlord.

Alternative ingine ni kuhamia mtaa more affordable. Wacha tuseme that huku kanairo, not all neighbourhoods are equal. For example, the closer mtaa yako iko to the cbd, ama the closer keja yako iko to main roads, the more expensive rent yako itakuwa.

Kama wewe huwork remotely na huhitaji kucommute to your hustle everyday, kuhama inaweza kuwa a suitable option for you. Hata unaweza pata keja kubwa for less money nje ya the city.

9. Reduce Transport Costs

Place ingine your money is going to ni transportation. Obviously hatuwezi stay home to save money. Inabidi we move around kuhustle, kumeet friends and family, and kulive life tu.

Kama unaenda mahali karibu, consider kutembea. Na kama uko na bike, cycling pia ni option poa. Hii inaweza kusave doh. Sio kila siku boda ama uber. There is a time and place to call an uber and take a boda, but kama unaweza avoid it, panda matatu. That’s the cheapest way to move around.

Na ukipanda mat to get around, avoid rush hours, when fare hupandishwa.

10. Make Your Own Products Like Soap

Njia ingeine to reduce household expenses is by making your own products, kama soap na cleaning solutions. Homemade alternatives often huwa cheaper and free of harmful chemicals, making them better for both your wallet and your household.

For example, unaweza make soap using simple ingredients kama coconut oil, maji, na caustic soda. Pia kuna homemade cleaning solutions that hutumia simple ingredients kama vinegar, lemon, na baking soda na zinaweza kuwa just as effective as stuff tunanunua. Kutengeneza your own products inaweza kuwa a fun and creative way kusave doh ama hata kuanzisha your own biz. Another big plus ni that there are plenty of online tutorials that show you how to get started.

11. Avoid penalties on loans

Place ingine unaweza hepa kupoteza doh ni loan penalties! Learn how to unaezea tumia loan responsively by reading how MESHERS make sure they ...

12. Pay-Yourself-First

Kama mtu ana run biz, inaweza kuwa hard kupredict doh utaingiza each week or each month. Kuna times poa biz imeshikam na times zingine ni ngumu. This is why people in biz huwa advised to pay yourself first, just like any other business expense.

Hii ina maanisha that every week or every month, una set aside a portion of your earnings for your personal needs and household costs kama rent, food, na bills.

Paying yourself first ina ensure that your personal expenses are covered without dipping into doh ya biz. It helps you live within your means and makes it easier to budget for both your household and your biz.

Goal ingine ya hii tip ni kuhakikisha way, that doh ya biz inabaki kwa biz to grow and reinvest, but pia huteseki, unapata yako ya kutumia for personal needs.

By applying hizi tips, unaweza reduce your household expenses, save money, and invest kwa other areas of your life, such as kugrow your biz, kugain new skills ama kulipa madeni. Saving doesn't always require sacrifices kubwa ama pesa mob— pia ni about making smart changes zenye zinaweza add up to big savings over time.

Can’t get enough?

Make more money by nailing your sales skills. Check out the Kuuzaa kama Boss series with Miss Kahiro and Dickons.