A Complete Guide To Loans For Small Businesses In Kenya

Accessing the right financing is important for small business owners in Kenya looking to kickstart or grow their ventures.

Are you a budding entrepreneur, a small-scale farmer upgrading your tools, or a creative professional expanding your digital business? Finding the right loan can make or break your plans.

Whether you need a quick cash boost for working capital, funds to purchase equipment, or financing to scale operations, let us help you to make informed, confident decisions tailored to your goals. 💰

Here are the questions we will answer in this article:

● Which organizations provide loans to small businesses in Kenya? ● What types of loans are available for small businesses?

● What tips are there for MESHERS seeking loans?

● Who are some loan providers i can get outside Nairobi?

● How do i choose the right loan for my business?

Want to increase your chances of getting approved for a loan?

After two years of partnering with loan providers we've discovered the two easy money habits that will massively improve your chances. Read the article.

👉 Download the MESH app Google Playstore. Ni 2MB!

Which Organizations Provide Loans to Small Businesses in Kenya?

If you run a small business in Kenya, kuna several ways unaweza access funding.

Some that we will talk about ni kama SACCOs, which offer affordable loans to members, banks zenye hu-offer structured business financing, digital loan apps kwa wale wananeed unsecured credit chap chap, na pia specialized lenders wale hucater to niche markets kama startups na farmers.

Tuziangalie indepth kiasi:

1. SACCOs (Savings and Credit Cooperative Societies)

It appears as though SACCOs will one day replace banks, specifically on the side of lending money. 💸 SACCOs are member-focused, na hupeana loans at interest rates that no other financial institutions can match.

Qualifying for these loans pia ni rahisi sana, since they prioritize financial inclusion. However, to gain access to a loan, you must be a member of the SACCO and you have to have access to guarantors. Some SACCOs even allow you to guarantee yourself from your own savings, which ni deal poa sana kwa wale wanaweza save diligently.

In addition to low interest rates on loans, one more advantage ya SACCO ni their profit-sharing aspect, as members receive dividends at the end of the financial year, something no other financial institution will do for you.

Watu pia hupenda SACCOs because of their flexible repayment terms.

Notable SACCOs you can join to get Small Business Loans include; Stima SACCO, Harambee SACCO and UNAITAS SACCO. But the good thing is that many institutions, including churches, industries like matatu owners and boda boda riders, and other organizations, have their own SACCOs, so finding one should not be difficult.

So, if you can do some research na ujue zile SACCOs people in your line of business are in, utakua mbele sana.

Do you want to know more about SACCOS? Find MESH' guide to SACCOS here.

Who are SACCO loans for?

SACCOs are ideal for:

Entrepreneurs who value lower interest rates.

Members with a history of consistent savings contributions.

Small business owners seeking flexibility in loan terms.

Members who feel safer getting loans from their own savings

Pros za SACCOs: Affordable rates and supportive community networks.🤼

Cons: Limited loan amounts, since they are directly tied to your savings. SACCOs pia huwa na a slower loan disbursement process compared to digital platforms.

Honorable Mention: Chamas

Chamas are fast becoming a go to for many small business owners, owing to the ease of access to small loans. Kwa wale bado hawaja sign up for a SACCO, a Chama is a great place to start. These small groups of people save together and they can lend to each other at very friendly interest rates.

Besides, when well managed, you will find chamas growing to the level of becoming SACCOs.

2. Digital Loan Apps

For MESHERS who need immediate access to funds, digital loan apps are arguably the fastest and most convenient solution.

Hizi apps, ata kama you need to be careful with them, require little to no paperwork and are accessible via mobile devices.

These qualities make digital loan apps popular among young entrepreneurs.📱

Be careful for scam loan apps and agents! Never pay a deposit or downpayment for a loan. Don't let people steal your hard earned cash. Educate yourself on latest biz scams today.

Leading digital loan Apps in Kenya

Tala – Tala hupeana loans between 1 and 50K, with repayment periods fixed according to your cash flow.

Branch – Branch hupeana loans from 250shs to 70K. Utapata loan depending on how you use your mobile money.

Fuliza by M-Pesa – Kila mtu ako na M-Pesa right? Fuliza is designed for short-term cash flow needs. Hii facility iko directly linked to your M-Pesa account.

Who are digital loans for?

Entrepreneurs wale wanatafuta quick, small-scale loans.

Wale watu wananeed immediate financial access, such as fuel for Uber drivers or inventory restocking.

Pros za digital loans: Instant loan approvals and flexible repayment terms.

Cons: Interest rates hapa are the highest compared to most other options. Pia, first-time borrowers huget limited amounts.

3. Specialized Loan Providers

Umewai skia about specialized loan providers? 💲

Specialized loan providers cater to niche markets, meaning that wanapeana tailored solutions to address the unique needs za entrepreneurs in specific industries.

Entrepreneurs wale wako in agriculture, retail, and manufacturing can find these providers with ease.

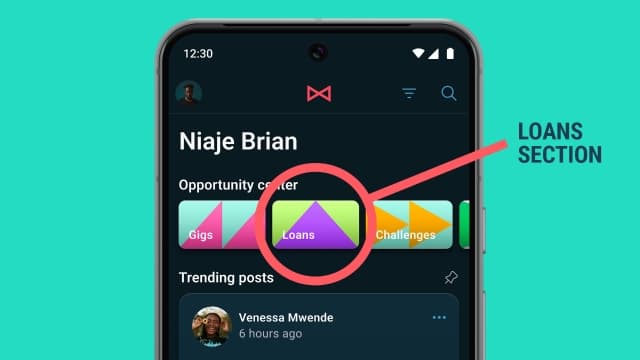

MESH regularly hosts loans from partners with special loans for young people and women. Check out the "opportunity center" at the top of your newsfeed.

Examples of Specialized Loan Providers

Pezesha - Hawa hufocus on providing working capital to small businesses. Hizi hupeana pia financial literacy support.

FarmDrive - Hawa huserve small-scale farmers by utilizing mobile money transaction data for credit scoring. Wanasaidianga farmers kupata access to agricultural financing.

Women Enterprise Fund - Ladies hapa wako na advantages kibao. 💃This organization offers affordable loans to women-led businesses, promoting financial inclusion and business growth.

Who are specialized loans for?

Unaweza endea izi loans kama unameet hii criteria:

Wewe ni entrepreneur in a targeted sector kama agriculture ama retail.

Women and youth looking for financial empowerment.

Wewe uko na startups ambayo haina traditional credit history lakini uko na alternative data point kama mobile money usage.

Pros za specialized loan providers: Custom loan products and innovative credit assessment models. These also offer a lot of support and training to help borrowers grow themselves and their businesses.

Cons: Hizi ziko limited sana to specific industries or demographics. Pia, since they are highly specialized, some will require you to meet some specific standards, which some can find frustrating.

4. Banks

For the longest time, banks zimekua the go to place for loans and all types of financing. Hizi institutions hupeana different types of loan products, ambazo watu huaccess and are offered a structured system ya kulipa izo loans. 🏦

For many years ilikua ngumu sana for watu ambao hawana capital mob kuaccess loans, but things have really changed in the recent past. Kuapply ni ka process bado, but banks bado ndio some of the best lenders for entrepreneurs na pia startups ambao wako na proper documentation.

Top Bank loan products

Equity Bank - Hii bank inakuanga kila pahali, which is a great advantage. Ikon a loan products kibao, lakini moja inaeza kua of interest to the lady-MESHERS out there called "Fanikisha". Hii product ni ya women entrepreneurs, na in offer flexible repayment schedules and asset financing.

KCB Bank - This is arguably the biggest bank in the country. It offers working capital loans, overdraft facilities, and SME asset financing. Hizi products zote ni za ku help businesses to grow and become even more profitable.

Co-operative Bank of Kenya - Kama biz yako inafall in the category of Micro, Small, and Medium Enterprises, then hii bank itakusort. Co-op offers MSME Term Loans with extended repayment periods of up to 60 months, hii ni ideal because itakusaidia kugrow.

Who are bank loans for?

Utapata loan virahisi kwa bank kama uko na access to the following:

A good credit history.

Stable income records.

The ability to provide collateral or meet application requirements.

Pros za banks: Banks hupatiana access to large loan amounts na pia wanaoffer a variety of financial products for your personal and business needs.

Cons: Processing times zinakuanga refu, especially if unaneed pesa mob. Pia banks zinakuanga na strict eligibility requirements, so you need to have the proper documentation. Since banks hutumia credit ratings kupatiana loans, a poor rating will mean higher interests. Pia, some internal or external factors zinaweza fanya interest rates zishoot up, and this can be so frustrating to small business owners.

What Types of Loans Are Available for Small Businesses?

Ukiweza jua the the types of loans offered by these entities utaweza ku align your financing needs with the right product.

Working Capital Loans

Hizi ni za kufinance day-to-day business operations, kama kumake inventory purchases or paying bills. Hizi loans ni poa for startups and SMEs with consistent cash flow needs.💷

Unsecured Loans

Hizi loans do not require collateral but often demand a good credit history or income proof. Wale entrepreneurs hawana significant assets wanaeza endea izi.

Asset Financing

Hizi loans husaidia kupurchase equipment, vehicles, or machinery, with the asset serving as collateral. Izi ni ideal for expanding operational capacity.

Microloans

Small loans from microfinance institutions ama digital platforms ni poa zikienda kwa micro and small enterprises. Hizi ni poa kwasababu these startups require modest capital injections.

Invoice Financing

Hii financing huoffer advances against unpaid invoices. Hizihupeana immediate cash flow ukingoja client alipe. Hizi ni useful sana for businesses managing delayed receivables.

What Tips Are There for MESHERS Seeking Loans? ☺

Purpose ya loan ni what? Clearly define why you need the loan (e.g., working capital, asset purchase, business expansion).

Can you survive without more loans? Please, please, na tafadhali, kama you do not need the loan, wachana nayo tu. Many small business owners get into overlapping debts, which can eventually bring down the business.

How do the providers compare? Evaluate interest rates, fees, and repayment terms to choose the most affordable option.

Na je ukichelewa, what next? Watch out for hidden charges and penalties on late payments, each lender has their terms and conditions for this, and if you’re not careful, you might end up paying more than twice the amount you asked for.

Would you partner with MESH? Leverage MESH partner offers for tailored financial solutions and networking opportunities.

Kuna regional options available? If you're outside Nairobi, tafuta county-specific SACCOs or government-backed initiatives zenye zinasupport small businesses kwenye uko.

Who Are Some Loan Providers I Can Get Outside Nairobi? 🌆

For MESHERS running businesses nje ya Nairobi, access to financing is just as critical. Fortunately SACCOs, and MFIs are actively bridging the gap, making entrepreneurs across counties have the cash they need to grow.

Financial institutions ambazo unaeza pata loans and other financial assistance ziko spread out all over the country. Zike unaeza pata virahisi ni kama:

Microfinance Institutions (MFIs)

Microfinance Institutions offer tailored financial products za kusaidia watu wa biashara. Some of the leading ones include:

Kenya Women Microfinance Bank (KWFT) - KWFT is one of the largest microfinance institutions in Kenya, hawa hu focus on empowering women entrepreneurs. It offers products like Biashara Loans for small business operations, inventory purchase, na asset financing.

Faulu Microfinance Bank - Faulu huoffer a range of products, kama SME loans, group loans, and agri-business loans, pamoja na financial literacy training to ensure borrowers manage their finances effectively.

County-Specific SACCOs

SACCOs operating at the county level offer solutions tailored to the needs of entrepreneurs wenye wanaishi in specific regions. Examples ni kama:

Bungoma Teachers SACCO (Bungoma County) - It provides loans for farming, retail, and trade.

Imarika SACCO (Kilifi County) - Imarika SACCO supports small businesses through products like Jitahidi Loans, designed for traders, agribusiness owners, and other small-scale entrepreneurs.

Emerging County-Based Loan Providers

Wacha SACCOs and MFIs, counties are seeing the rise of development funds and local initiatives designed to boost businesses ndogo. Zile unaeza tafuta ni kama Kitui County Empowerment Fund na Nakuru County Enterprise Fund.

How Do I Choose the Right Loan for My Business?

So, how do you choose a loan for your business?

Kupata the perfect loan option unafaa kuevaluate your business needs, goals, and repayment capacity.

Here is a step-by-step guide for MESHERS:

Step 1: Define Your Loan Purpose

Working Capital Needs - If your goal is to manage day-to-day expenses like inventory restocking or rent, unaweza endea working capital loans from SACCOs, MFIs, or banks.

Expansion Goals - Kama unataka kununua equipment, kuexpand premises, ama kuhire additional staff, asset financing from banks or specialized providers like KWFT ni ideal.

Quick Cash for Emergencies - Digital loan apps kama Tala or Branch ni poa for meeting short-term, urgent cash needs.💰

Step 2: Evaluate Repayment Terms

Analyze repayment period and monthly installment requirements za loan ile unataka.

Tip: If your business has irregular cash flow (e.g., seasonal sales), look for loans with flexible repayment schedules like those from Faulu or SACCOs.

Step 3: Compare Interest Rates🤑

Banks huwa na competitive rates but stringent conditions, but SACCOs and MFIs offer lower rates, especially for members.

Caution: Digital loan apps often have higher rates due to the convenience of instant approval.

Step 4: Check Eligibility Requirements

Banks huneed ukue na collateral, audited financial statements, and credit reports. SACCOs demand membership and savings history. Digital apps hurely on M-Pesa transaction data, making them accessible but with smaller loan amounts for first-timers.

Step 5: Consider Accessibility

For MESHERS in rural or peri-urban areas, proximity to a loan provider is crucial. County-Based SACCOs and MFIs are ideal for entrepreneurs operating outside Nairobi.

Digital Loan Apps nazo ni perfect for those seeking quick access without visiting a physical branch.📲

By exploring these loan options, MESHERS wanaeza pata the right financing to grow their hustles, whether wako kwa cities and towns kama Nairobi ama remote parts of the country. With MESH, you not only access financial resources but also a platform to promote your business and connect with potential customers.

How Does MESH Support Small Business Financing?

Although MESH is not a loan app, it connects small businesses with partner offers and resources to access funding. As a MESHER, unaweza pata exclusive deals, financing advice, and training za kukusaidia uweze kunavigate the borrowing process effectively.💁♀️

Need a loan but unsure where to start?

Explore MESH for expert tips and advice. Unaweza pia watch the loan mini-series by Otachi to understand good debt vs. bad debt. You can also find out how to get a loan you can afford, ndivo usiingie kwa shida in the long run.

Una-need a small boost for daily operations ama significant funding for expansion? Hii guide na zingine kama hii zitakupatia tips so you make informed decision to grow your business confidently.