Money Market Funds 101: Everything You Need to Know About Safaricom Ziidi

Money market funds (MMFs) are having a moment. Everyone’s been talking about them for the past year or so, na Safaricom wameingia scene last month na Ziidi.

But what exactly are MMFs? Are they a safe investment? More importantly, ii Ziidi inawork aje?

Let’s find out. Questions? Leave them in the comments below!

DISCLAIMER: any investment carries risk. You can lose your entire investment. Never invest money you cannot afford to lose.

What is a Money Market Fund?

MMFs ni a type of mutual fund zenye ukua managed na fund managers. Ukiinvest, fund managers wanacombine pesa yako na ya other investors, then wanainvest in low-risk investments kama short-term loans to governments or big, trustworthy companies. These underlying investments are generally stable—that's why financial experts usema MMFs ni low-risk investments.

Watch Ivy explain Money Markets.

Here’s why MMFs are cool:

⦁ Ni safer than most investments: experts say it’s not as risky as putting money into stocks.

⦁ Ziupeana better returns than a savings account: although MMF returns uchange with time based on the performance of underlying investments, they’re generally higher than what you’d get if you put the money in an interest-bearing savings bank account or Mshwari.

⦁ You can withdraw your money anytime: you can’t do this with many other investments such as stocks. And if they allow you to do it, you’ll likely have to pay a penalty.

Are Money Markets Safe to Invest In?

Depends on how you define “safe” when it comes to investments. Like any other investment, MMFs carry a risk. That means there’s always a chance of losing your money. So if “safe” to you means zero risk, then no, MMFs aren’t “safe” — and no other investment is for that matter. Ka unataka zero risk, stick to your good old savings account—the interest rate is lower, but uko assured huezi lose pesa yako.

Need to save some cash? Here are MESHERStop tips za kusave doh🚀.

But if “safe” means “low-risk” to you (like it does for most investors), then MMFs are some of the safest investments you can put your money in. They’re a great way to make your money work harder than it would in a savings account without taking big risks.

Now the fact that MMFs are safe investments doesn’t mean you can’t lose your money. There’s still a chance of that happening; it’s just lower. So as you invest away, usisahau the golden rule: never invest more than you can afford to lose! If it’s money you’ll need for important stuff like living expenses, emergencies, medical bills ama fees, you’re better off putting it in a savings account.

How can you Invest in Money Market Funds in Kenya?

Kuinvest in an MMF ni rahisi: all you need to do is choose an MMF that suits your needs, register, make a deposit, and start monitoring your investment. The trickiest part ukua kuchoose the right MMF ju kuna different options, each designed with a specific type of investor in mind. Here’s what to consider when making that choice:

⦁ Potential returns: Calculate the potential returns of all MMFs you’re considering and compare. This should be easy with a user-friendly calculator likeAfrica’s Pocket.Simply select your saving goal and key in the requested values; itakupea the exact return you can expect from your investment.

⦁ Minimum deposit: Make sure uneaza afford the minimum investment required for the MMF you’re eyeing.

⦁ Fees: MMFs ukua na management fees and other charges (e.g. trustee, transaction, and administrative fees). Exploitative charges can eat into your returns, so make sure umechoose MMF iko na friendly fees.

⦁ Liquidity. Some MMFs restrict the number of free withdrawals you can make in a month.Old Mutual and Sanlam are great examples – you get one free withdrawal per month, and a fee is charged for subsequent withdrawals. Other MMFs like Cytonn and Apollo zinaallow unlimited withdrawals. Ultimately, savings goals zako ndo zitadetermine how much of a priority unlimited free withdrawals are to you.

What is Safaricom Ziidi?

Safaricom Ziidi is a new investment product by Safaricom after previously launching Mali, which got mixed reviews.

Safaricom’s Ziidi an MMF designed for the common mwananchi. Unaeza invest with as little as 100 bob na uwithdraw as many times as you wish in a month with no penalties.

And unlike many MMFs, Ziidi ni zero-rated, which means deposits na withdrawals hazina transaction or maintenance fees.

Like all Money Market Funds, Ziidi's interest rates zina-go up & down. Ziidi ili-offer 12% or more interest in 2024, but ili-drop to a little over 6% in 2025. Make sure una-check the current interest rates before investing. A savings deposit inaweza kua a safer & more effective savings option for you.

However, any interest you earn will attract a fund management charge of 2% per annum.

Speaking of interest, pesa yako uanza kuearn daily interest 24 hours after umeinvest. The interest rate fluctuates daily based on the performance of the MMF’s underlying investments, and your daily earnings are usually indicated pale kwa M-Pesa app. If you don’t have the app, unaeza cheki earnings zako by dialing *334#.

Another cool thing about Ziidi is that it allows you to lock your funds as long as you want. This is great for those of us who often give in to the temptation to spend our savings. You can always unlock your funds, but there’s a 72-hour waiting period to discourage people from unlocking to fund impulse buys.

How do You Open an Account with Safaricom Ziidi?

Unaezea fungua account ya Ziidi in two ways: using the Mpesa app or by dialing *334#. Here are the steps for both options:

Mpesa app:

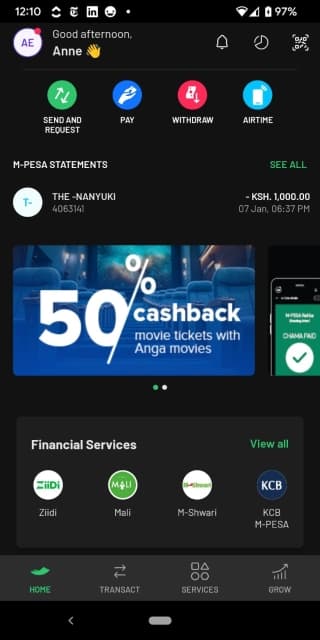

⒈Fungua Mpesa app then click on “Financial Services.”

⒉Find the Ziidi icon and click on it

⒊Eka amount unadai kuinvest then uconfirm

⒋Utapewa option your kulock investment yako; your choice!

If you prefer to use *334#, steps ziko ivi:

⒈Dial *334#

⒉Kwa menu itatokea, select the “Financial Services” option

⒊Utaletewa menu iko several options: select Ziidi

⒋Accept terms and conditions then proceed

⒌Enter your Mpesa pin

⒍Utatumiwa message iko na instructions on how to complete registration. Ni easy steps anyone can complete.

Once registered, all you need to do is keep monitoring your investment through the Mpesa app.